Hire Remote Financial Software Developers Effectively

When developing financial software, hiring the right talent is crucial. Financial software developers play a significant role in designing and implementing robust, secure, and efficient software solutions for the finance industry. Whether you're a fintech startup, a banking institution, or an established financial services provider, finding and hiring a skilled financial software developer is essential for the success of your fintech project.

Developing financial software requires a unique set of skills and expertise. Financial software developers must deeply understand financial concepts, regulations, and industry-specific requirements. They must be proficient in programming languages such as Java, C++, or Python and have experience with database management systems, security protocols, and data encryption.

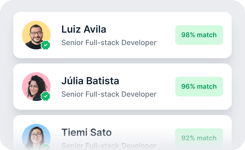

When hiring fintech software developers, it's essential to consider their technical skills, industry knowledge, and problem-solving abilities. Please look for candidates with a track record of working on financial software projects. They can demonstrate their expertise in developing solutions that meet compliance standards and adhere to industry best practices. Practical communication skills and the ability to work collaboratively in a team environment are also essential.

The following sections will explore key factors when hiring top financial software developers and architects, including their technical skills, domain knowledge, and the best strategies to ensure you find the right talent for your organization's specific needs.

What to Look for When Hiring Financial Software Developers

Technical Skills

When hiring fintech developers, it is crucial to assess their technical skills to ensure they possess the necessary expertise for developing complex financial software solutions. Please look for candidates proficient in programming languages commonly used in the finance industry, such as Java, C++, or Python.

Hire fintech developers with a solid understanding of database management systems and experience with frameworks and tools specific to financial software development. Additionally, knowledge of financial concepts, algorithms, and mathematical modeling can significantly benefit their ability to design and implement efficient and accurate financial software solutions.

Communication Skills

Effective communication is vital in financial software development, as developers need to collaborate with stakeholders, including finance professionals, project managers, and other developers. When evaluating candidates, please consider their written and verbal communication skills.

They should be able to articulate complex technical concepts clearly and concisely and actively listen and ask clarifying questions to ensure they understand project requirements and goals. Strong communication skills foster better teamwork, facilitate efficient problem-solving, and contribute to the overall success of financial software projects.

Secure Data Handling in Financial Software Development

In fintech software development, ensuring the security and integrity of sensitive data is of utmost importance. Financial software developers must deeply understand data encryption techniques, secure coding practices, and compliance regulations such as PCI-DSS (Payment Card Industry Data Security Standard).

Look for a fintech software developer with experience implementing robust security measures, such as encryption algorithms, secure data storage, and access control mechanisms, to safeguard sensitive financial information and protect against potential cyber threats.

Integration of Financial APIs and Data Feeds

Integrating financial APIs (Application Programming Interfaces) and data feeds is another crucial aspect of financial software development. Fintech software specialists should be familiar with API integration techniques and have experience working with popular financial APIs and data providers.

They should understand how to retrieve and process real-time financial data, such as stock prices, market trends, or currency exchange rates, and seamlessly incorporate it into the software applications they develop. Please look for a software engineer who can show their ability to integrate APIs effectively and handle data feeds securely, ensuring accurate and up-to-date financial information within the software.

Top 5 Financial Developer Interview Questions

How would you handle data encryption in financial software development?

Asking this question allows you to assess the candidate's understanding of data security and encryption techniques in financial software development. A firm answer would demonstrate knowledge of industry-standard encryption algorithms, the importance of secure key management, and the implementation of encryption at rest and in transit.Additionally, the candidate should discuss strategies for protecting sensitive financial data and complying with relevant security standards such as PCI-DSS.

What is the process of integrating financial APIs into a software application?

This question helps you evaluate the candidate's experience integrating financial APIs, a critical skill for financial software developers. An ideal response would cover authentication and authorization mechanisms, API response formats (e.g., JSON or XML), error handling and retry strategies, and managing API rate limits. The candidate should also showcase their ability to work with API documentation and SDKs.

How would you optimize a financial calculation algorithm for performance?

By asking this query, you can assess the candidate's problem-solving skills and ability to optimize financial algorithms. An effective answer would involve analyzing the algorithm's time and space complexity, identifying potential bottlenecks, and proposing optimizations such as memoization, parallelization, or utilizing more efficient data structures. The candidate should demonstrate their understanding of algorithmic efficiency and the trade-offs between speed, accuracy, and resource utilization.

Could you describe your experience with financial reporting and generating complex financial statements?

This concept allows you to gauge the candidate's familiarity with financial reporting requirements and their ability to generate accurate and complex financial statements.The candidate should discuss their experience working with financial data, using relevant tools and frameworks for data manipulation and analysis, and understanding financial statement formats such as balance sheets, income statements, and cash flow statements. Strong candidates also highlight their attention to detail and adherence to accounting principles and regulations.

How do you ensure data integrity and consistency in financial software applications?

Asking this question helps you evaluate the candidate's understanding of data integrity and consistency, which are crucial in financial software applications. An ideal response would involve discussing techniques such as database transactions, data validation and verification, error handling, and auditing mechanisms. The candidate should demonstrate their ability to handle edge cases, prevent data corruption or loss, and ensure accurate financial calculations and reporting.